KIRKLAND, Wash., Sept. 17, 2018 – Highly Automated Vehicles (HAVs) are poised to radically impact the future of the long-haul trucking sector. However, where their deployment is best suited for initial success remains unclear. Without smart planning, HAVs have the potential to clog roads, increase pollution and further divide mobility options. INRIX, the global leader in connected car services and transportation analytics, has identified corridors in the U.S. that are positioned to most immediately benefit from early autonomous trucking deployment.

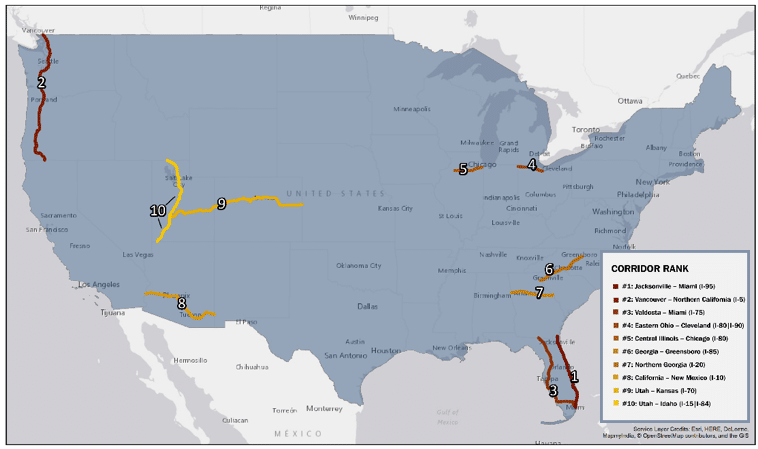

Top 10 Corridors for Commercial Returns

The INRIX Automated Freight Corridor Assessment is based on the premise that the commercial benefits of current HAV technology are best suited for trips of longer duration and those without challenging traffic conditions (speed changes, congestion, incidents). To identify these corridors, INRIX Research first analyzed and ranked U.S. corridors that measure more than 100-miles with high freight volume and low congestion characteristics. The U.S. has a number of routes that are solid candidates for HAV deployment due to the prevalence of high volume, low congestion corridors. However, this broad distribution will likely lead to a more diffuse pattern of HAV adoption as compared to countries where a select few routes stand out above all others.

Despite its comparatively short length, I-95 (Jacksonville to Miami) ranked the best commercial corridor as a result of its very high freight volumes and low congestion levels. I-5, from the Canadian border to Northern California, scored second for initial autonomous truck deployment due to its low congestion rates, high freight volumes and overall length of the road.

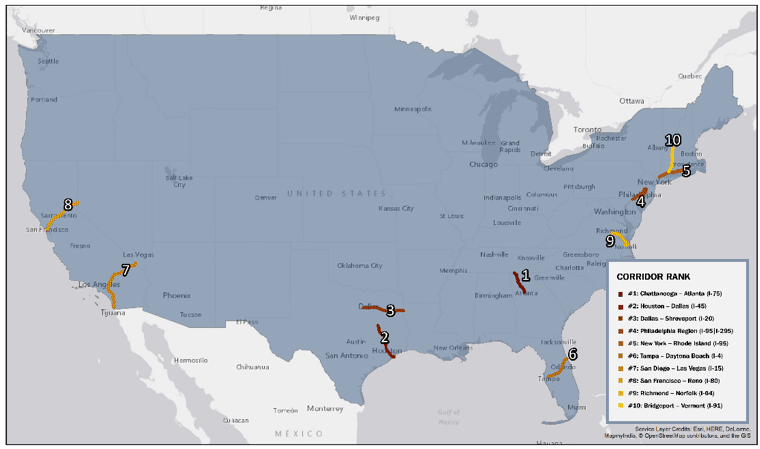

Top 10 Corridors for Safety Improvements

In consideration of the public focus on prioritizing the safety benefits of HAVs, INRIX Research identified corridors with high incidence rates to show where HAV technology could have the most impact. The best fit U.S. corridors were identified by finding 100-mile segments with the highest number of incidents (i.e. crashes, slowdowns, construction). By augmenting drivers’ skills with HAV technology, the driving risks on these routes could be greatly mitigated.

Of the corridors analyzed, I-75 from Chattanooga to Atlanta ranked highest in terms of driver risk. The road’s high freight volume, coupled with a high incident rate, differentiated it from other corridors that exhibited higher incidents per mile or overall volumes. I-45 between Houston and Dallas landed second in the safety rankings due to its exceptionally high incident rate – at least 10 percent higher than any other U.S. corridor studied.

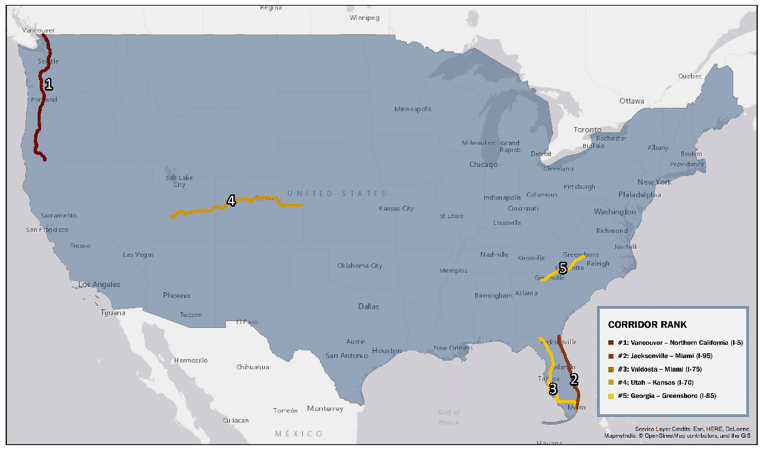

Top Five Combined Corridors for HAV Deployment

The U.S. holds exceptional promise for the deployment of HAV technology due to the high number of long-distance routes, increasing labor costs and positive progress towards a unified regulatory framework. The benefits that stand to be maximized (commercial versus safety) vary based on the corridors selected for initial operation. Access to accurate volume, congestion and safety profiles are essential to this evaluation process.

As the public and private sector works together to select initial testbeds for HAV technology in commercial trucks, these corridors present immediate opportunity for both parties to realize early benefits of the technology and increase the likelihood of successful deployments that both deliver commercial gains and increase road safety.

Based on INRIX research and analysis, the most ideal U.S. corridor for initial deployment when normalizing freight volume, route length, congestion and incident rates is I-5 from the Canadian border to Northern California. This route scored the highest in our combined score due to its length and its high incident rate when compared to other low-congestion corridors. I-95, from Jacksonville to Miami, scored exceptionally well in terms of congestion, but its low incident prevented it from ranking first.

“Big data is an essential tool that should be used as the public and private sectors explore and deploy HAVs,” said Avery Ash, head of autonomous mobility at INRIX. “Mobility data and analytics are more powerful when multiple layers – such as congestion, volume and incidents – are added into the equation. Using data-driven insights will allow commercial truck operators and road authorities to proactively leverage HAVs to solve key mobility and business challenges.”

Road authorities around the world are currently considering autonomous vehicle deployment on public roads. Big data analysis and a deeper understanding of mobility will help the public and private sector stakeholders strategically plan to bring HAV technology to market in a way that benefits citizens and businesses alike.

To see the complete INRIX Automated Freight Corridor Assessment, please visit.

###

Note to Editors:

Research Methodology

Leveraging aggregated INRIX data from millions of connected vehicles worldwide (passenger and commercial), INRIX provides valuable insights to prepare for the early adoption of automated trucks on public roads. Using a systematic, data-driven approach, the INRIX Automated Freight Corridor Assessment identifies corridors where HAVs are best suited to first take the road, based on several different metrics for success. To determine the best corridors for autonomous truck deployment, INRIX Research used three key variables: freight volume (via INRIX Trips), congestion levels (via INRIX Roadway Analytics) and incidents rates (via INRIX Incidents). Additional metrics are available online and in the full report.