As covered in the previous blogs in our ‘Return to Office’ series – the shift toward remote work during COVID-19 resulted in a significant drop in vehicular trips to and from downtowns. So far, we have examined travel behavior in 20 U.S. downtowns, aiming to comprehend “new normal” travel patterns.

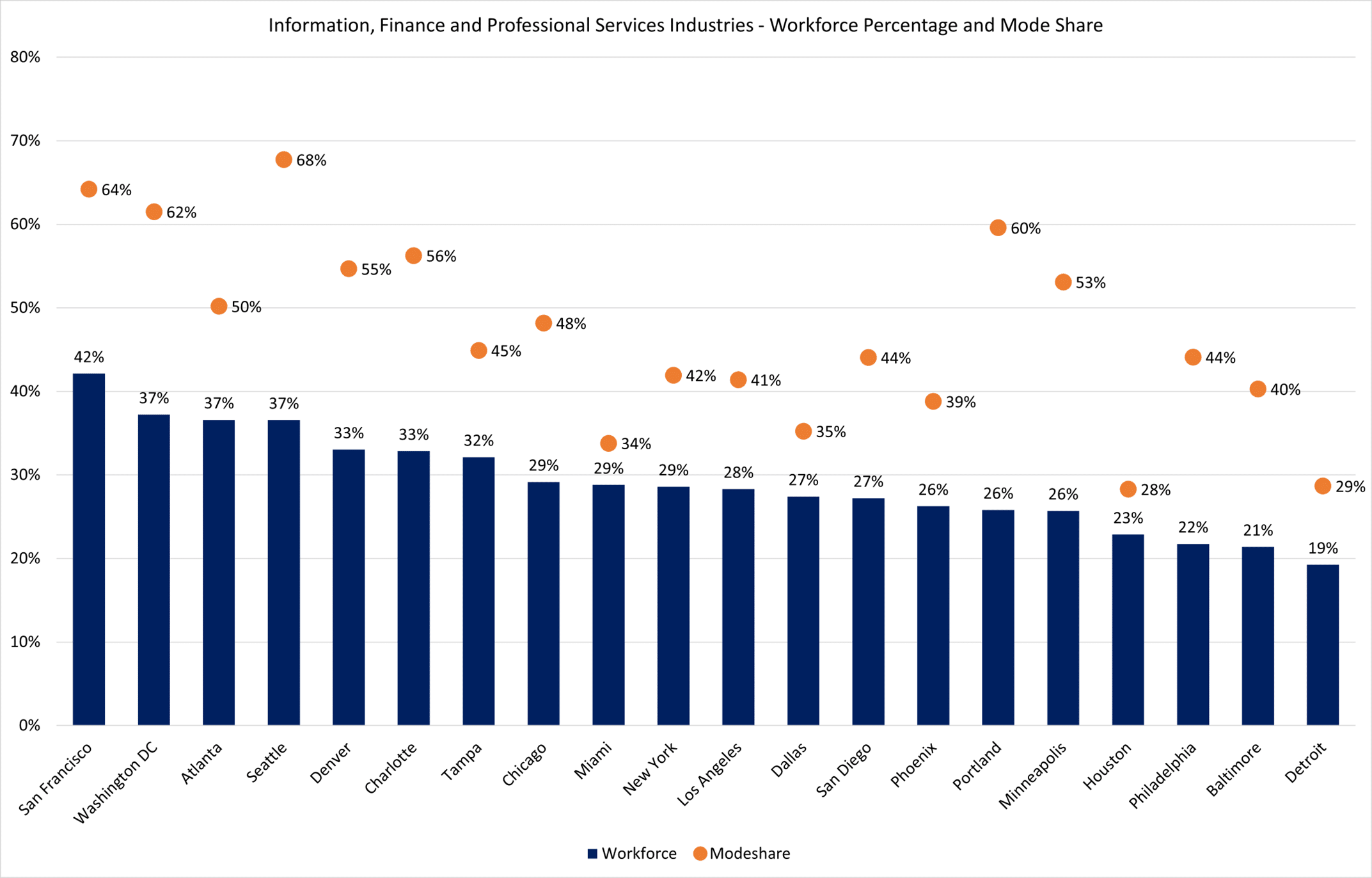

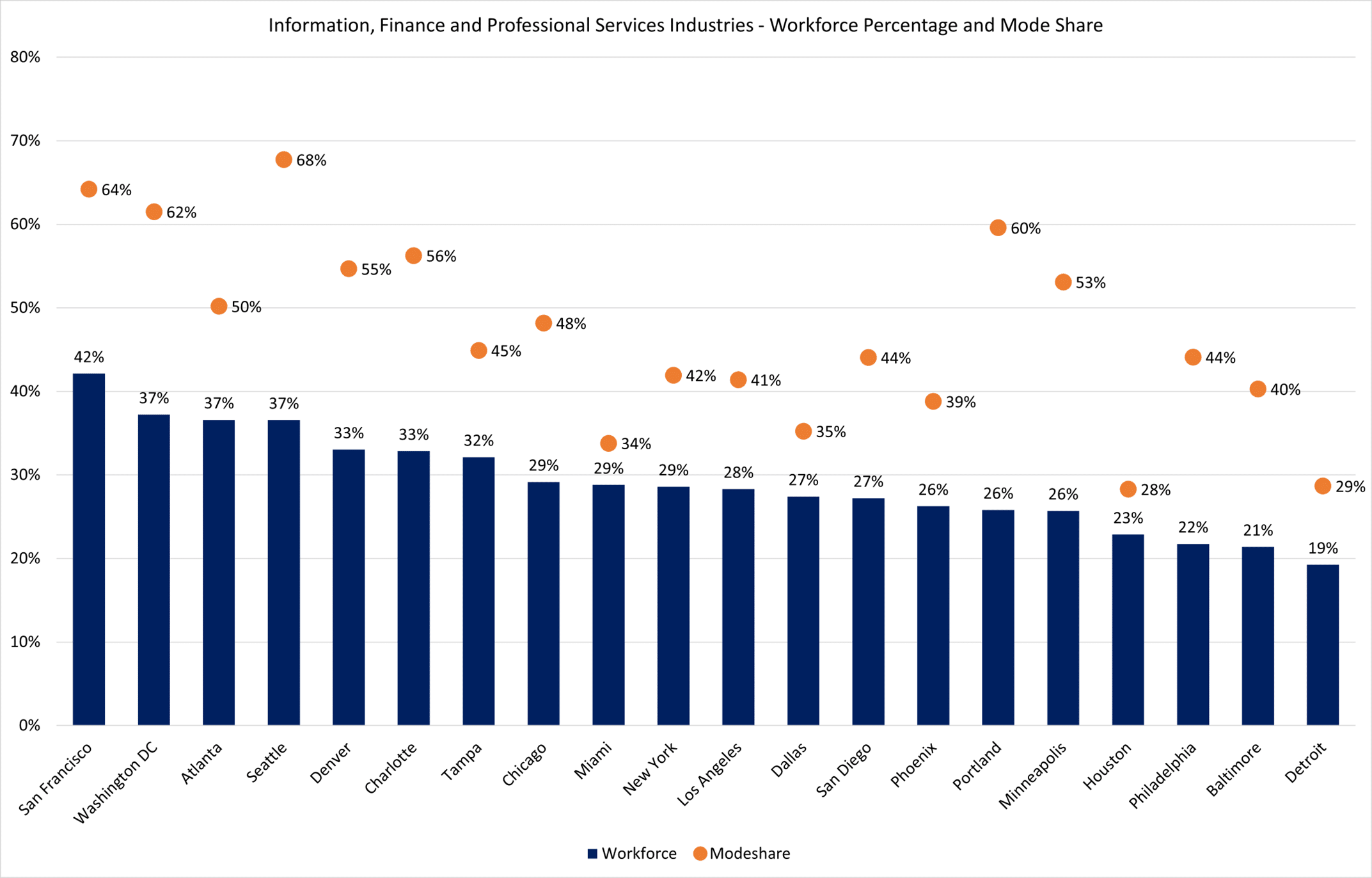

From our last blog, we know that cities with a large presence in the Information, Finance, and Professional Services industries tended to see fewer vehicle trips during COVID-19. Presumably, due to a slow “Return to Office” in favor of “hybrid” work policies.

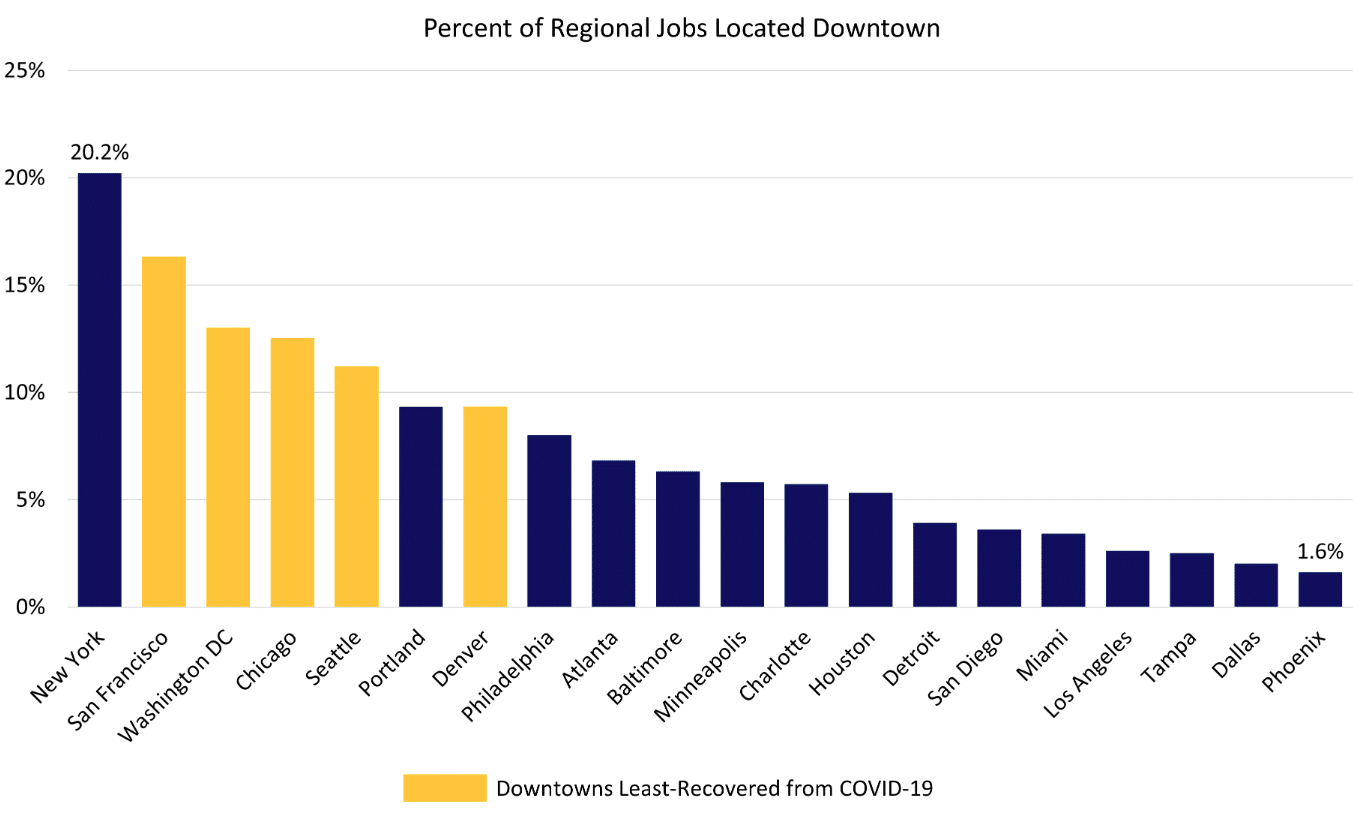

Based on INRIX Trip data, downtowns exhibit variable recovery, with some showing greater recuperation from COVID-19 compared to others. Moreover, we found downtowns with high concentrations of regional jobs experienced slower trip recovery compared to their more-sprawling counterparts.

Demographia’s analysis of job-density in downtowns across the U.S. highlights the significant variation in employment density across the downtowns studied. From a high of 20% of regional jobs located (Manhattan) to a low of 1.6% (Phoenix).

Yet as the chart below reveals, it appears that downtowns with substantial job centers are the slowest to recover in terms of vehicle trips, with four out of the five most job-dense downtowns also the least recovered in terms of trips (San Francisco, Washington D.C., Chicago, and Seattle).

Interestingly, three that are among the least recovered are also in the top five in terms of the percentage of workforce in the surrounding area that are in the Information, Finance, and Professional Services industries.

Further, according to the U.S. Census Bureau, workers in those industries also tended to telecommute more than their peers in other industries.

In three of these areas, more than 60% of commuters in these industries telecommuted, and in all four, telecommuting was the primary mode of commuting.

New York continues to be an outlier. While its downtown has the highest concentration of regional jobs compared to anywhere studied, vehicular trips have essentially recovered to pre-COVID levels. Notably, the city of New York is much more diverse in its industrial make-up, with just 29% of the workforce in Information, Finance, and Professional Services, versus 42% in San Francisco, the next job-heavy downtown on the list.

Additionally, those working in the three sectors also telecommuted at significantly lower rates than their San Francisco, D.C., Seattle, and Denver counterparts, with 42% of those in NY choosing telecommuting – versus 64% in San Francisco.

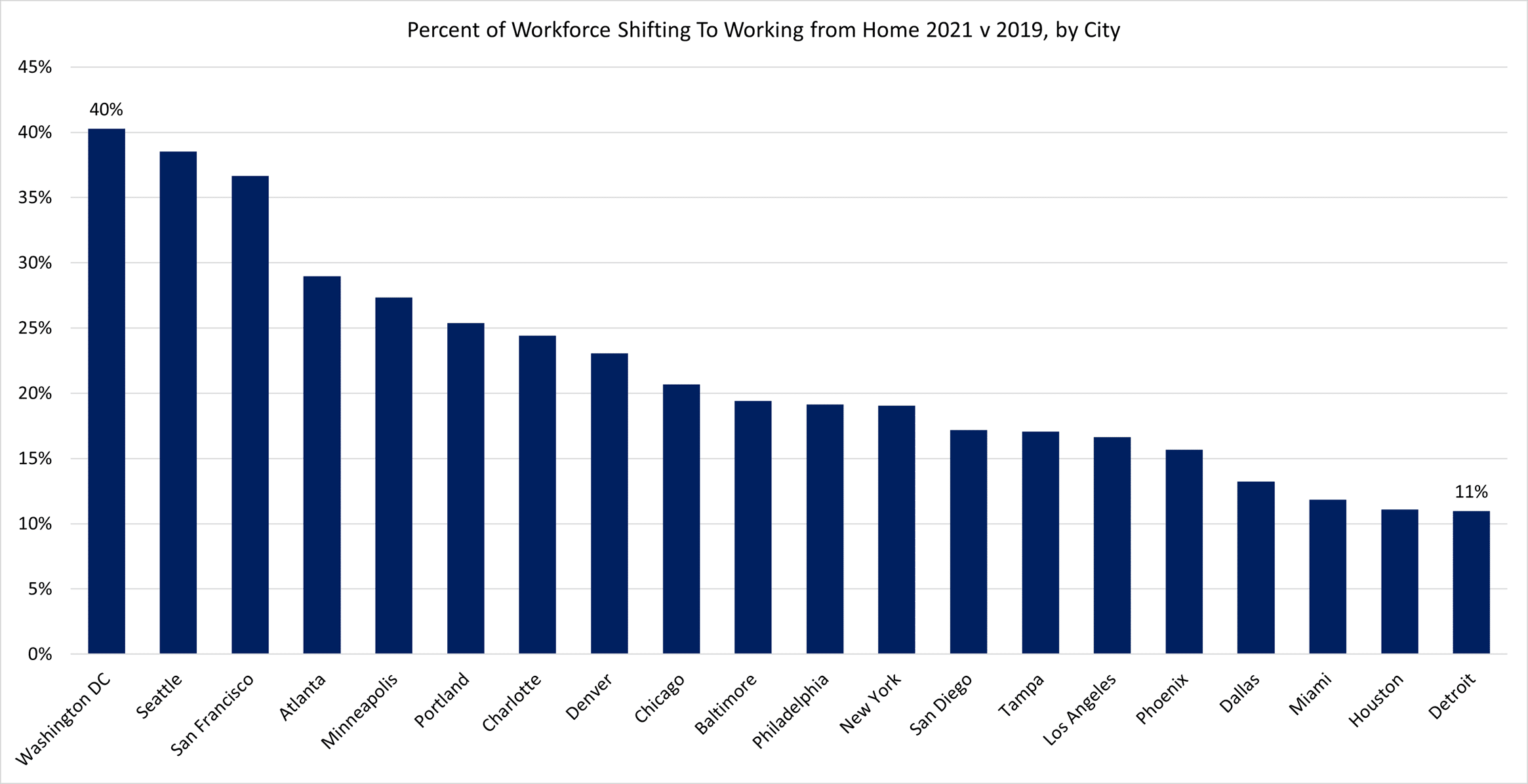

A major factor is the ability to telecommute. Simply put, during COVID-19, telecommuting rates increased significantly in metro area job markets that are more-anchored to downtown. Between 2019 and 2021, a significant shift in Washington D.C. occurred as 40% of the workforce transitioned from other modes to working from home. Other job-heavy downtowns also saw large increases in working from home, with Seattle, San Francisco, Atlanta, and Minneapolis rounding out the top five.

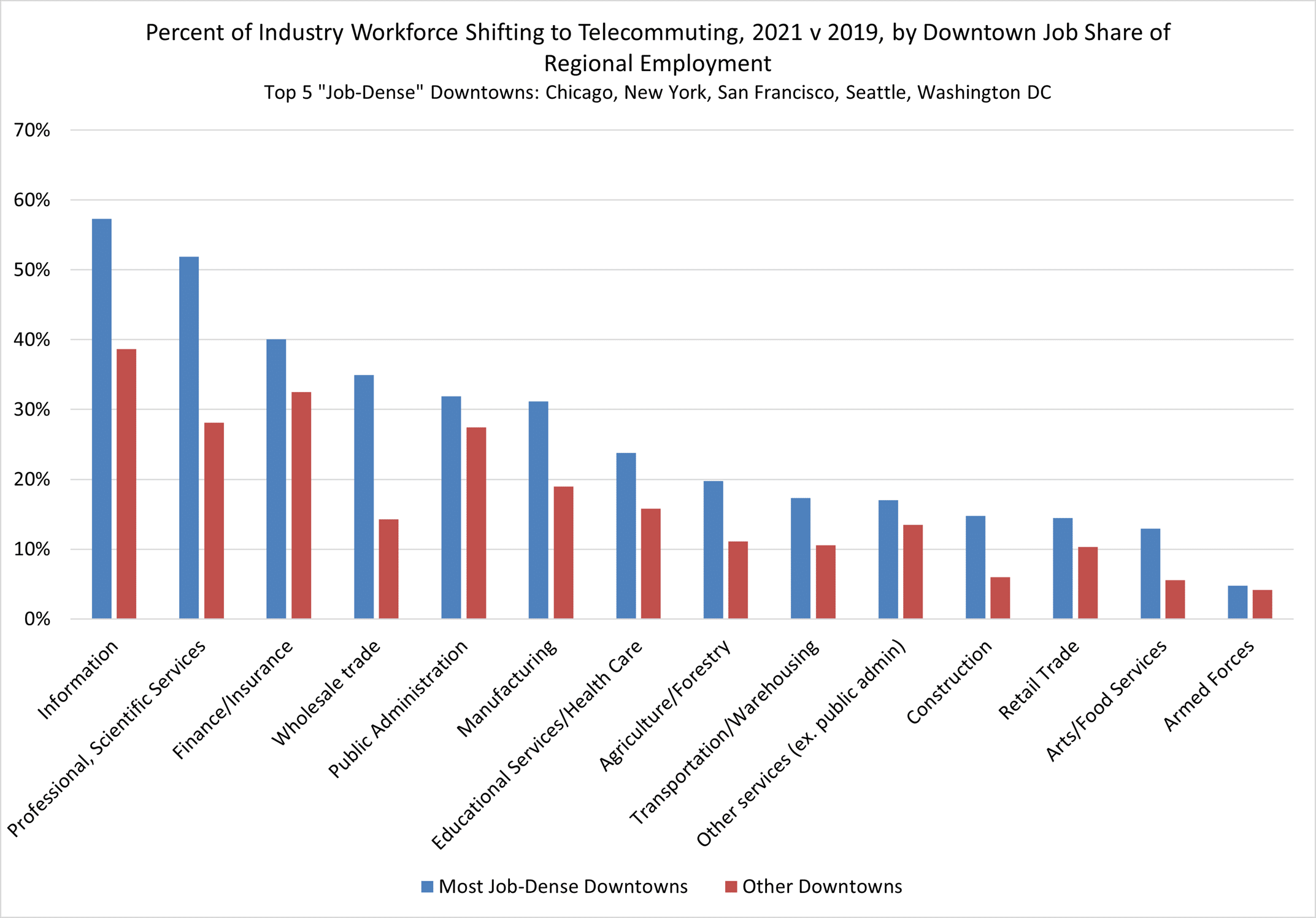

The extent of shifting to Work from Home, however, varied across industries and by city. Downtowns that hold a significant share of regional employment saw the largest shift to telecommuting across all industries, not just Information, Finance and Professional Services, though those industries had the largest shift to telecommuting across the board.

In summary, it appears that both the shift to telecommuting and reduction in vehicular trips was most prominent in areas where: a) downtown holds a high share of regional jobs; and b) downtown holds a high concentration of jobs in Information, Finance and Professional Services industries. Manhattan, which holds more than 20% of the region’s jobs, however, is notably absent from discussion, as its diversification of industries (as well as lower telecommuting rates to begin with) may be helping it achieve pre-COVID levels of traffic faster than its downtown peers.