Today, we released the 2022 Global Traffic Scorecard, highlighting traffic conditions in more than 1,000 cities in 50 countries. We found that in most countries, 2022 was a year of relaxed COVID-19 restrictions, high fuel prices, inflation, and changes in commuting and telecommuting habits – resulting in a mix of factors that increased, and decreased, travel demand.

The majority of urban areas and the country overall saw increasing travel demand in 2022. Across the globe, 58% of urban areas analyzed saw increased traffic delays over last year, while 38% saw delay decreases.

London remained the most-congested area analyzed at 156 hours of delay per driver, up 5% over last year. Big movers include second ranked Chicago, IL (155 hours, up 49%), Boston, MA (134 hours, up 72%) and Toronto, ON (118 hours, up 59%). Traffic in many North American cities came roaring back in 2022, a bit behind Europe, per our 2021 Scorecard.

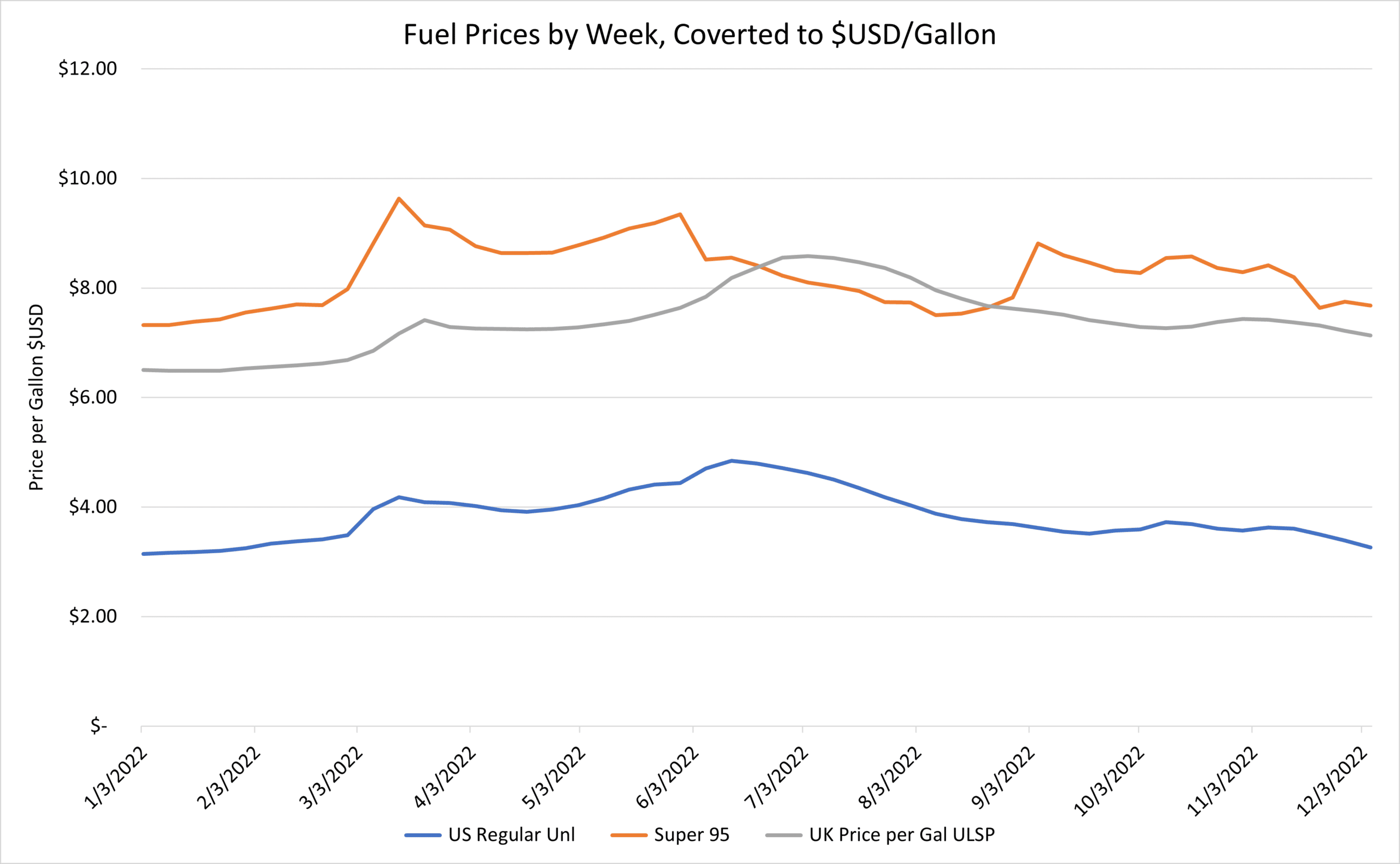

But oil prices were one of the top concerns of drivers, highlighted with near-daily media coverage of gas prices. US average national retail prices for regular gasoline according to the US Energy Information Administration began 2022 at $3.15 per gallon, rising to $4.84 per gallon in mid-June, falling to $2.97 by the end of December.

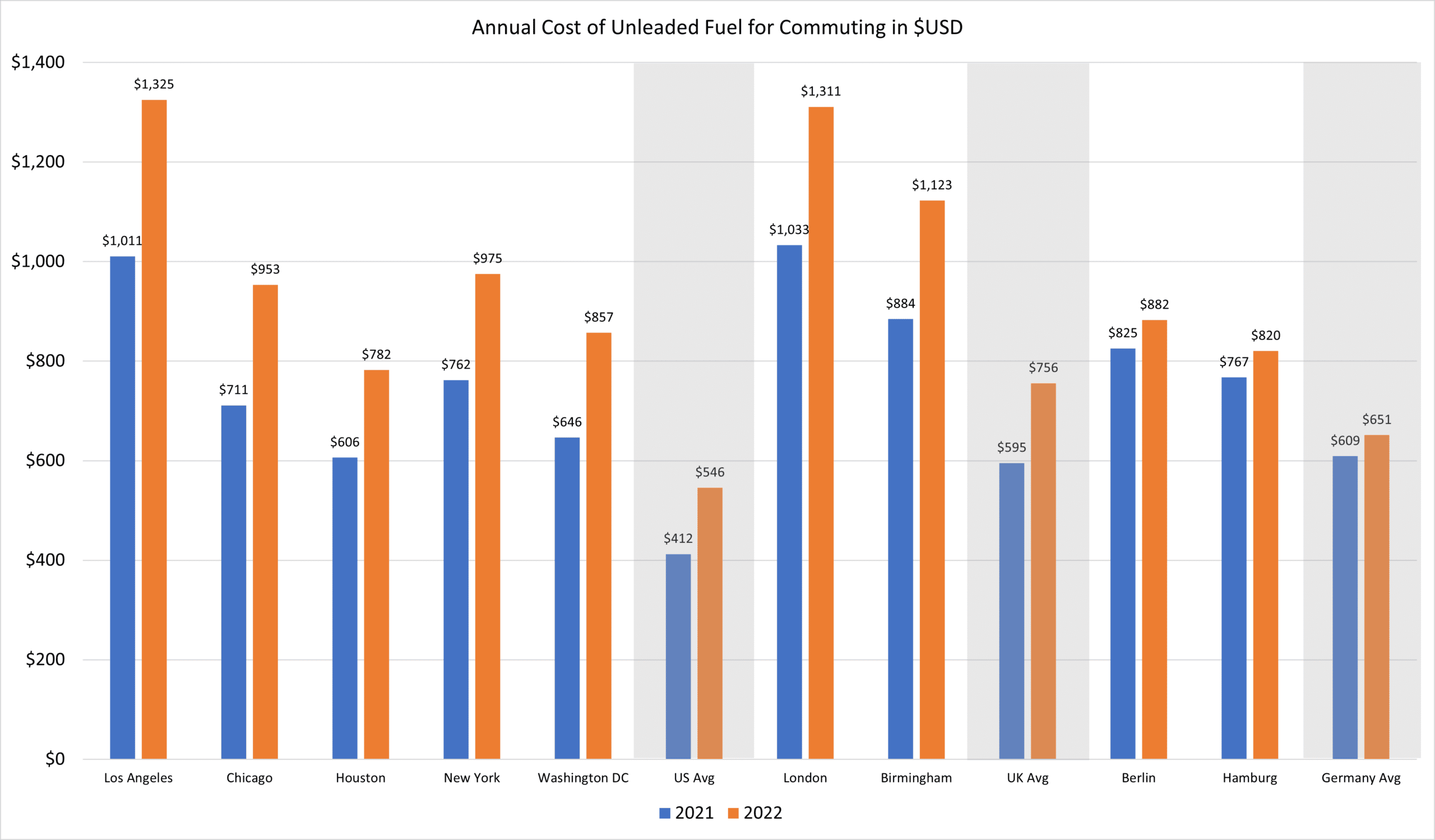

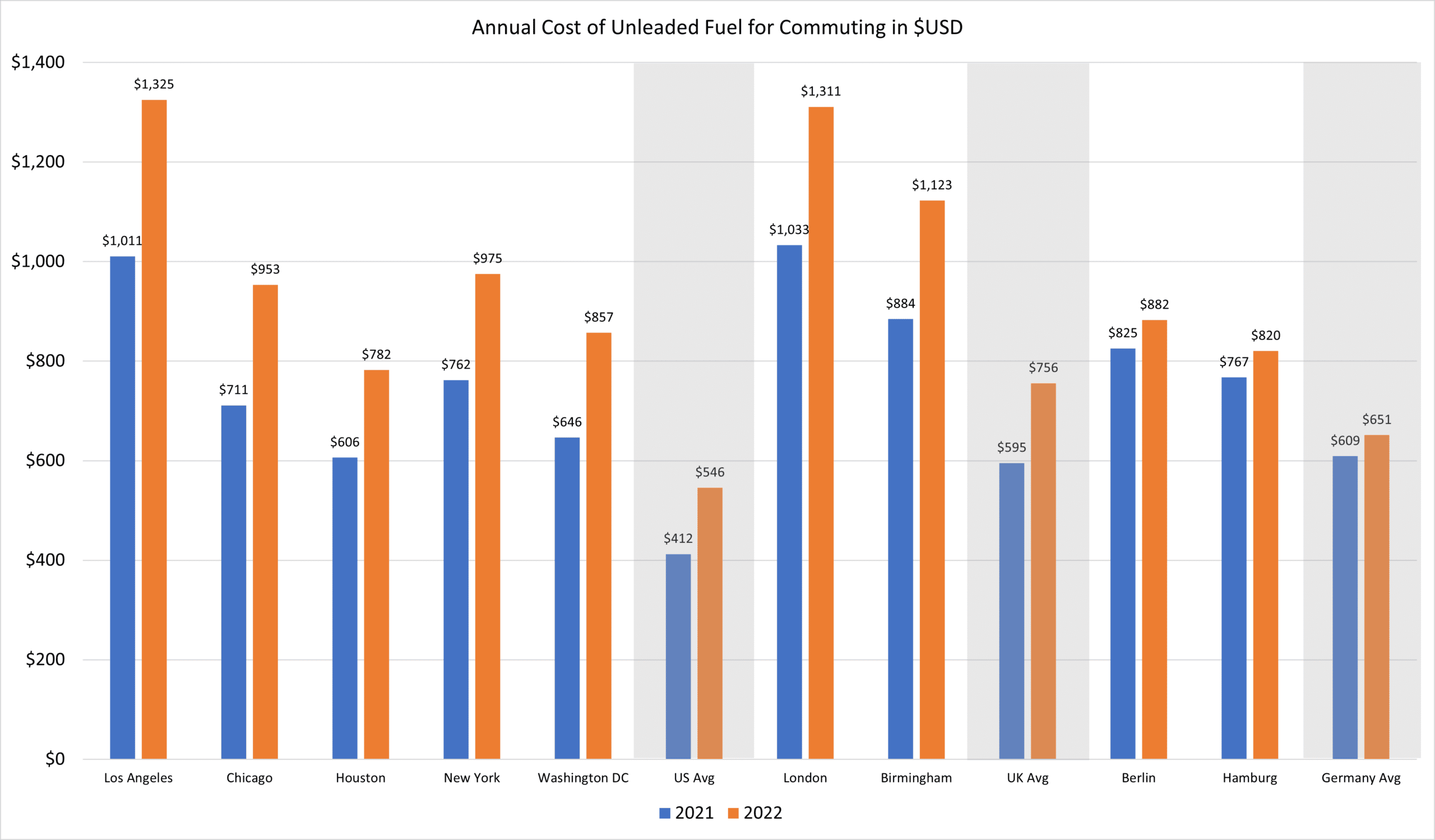

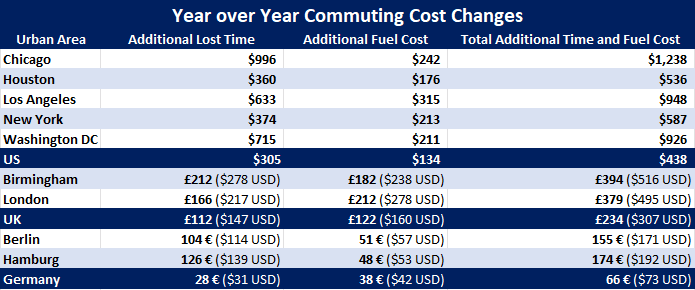

And prices at the pump varied by location. For example, in Los Angeles, the typical commuter spent about $1,325 for fuel last year, a $315 increase.[i] Drivers in Houston saw a smaller fuel cost increase of about $176 in 2022, while the typical driver across the United States paid about $134 more for regular gasoline.

When fuel cost is added to additional time lost behind the wheel, drivers in Chicago saw the greatest cost increase at $1,238 from year to year. In general, Germany saw the smallest increase in fuel prices due in large part to a temporary reduction in fuel taxes.

Of course, full time telecommuters, hybrid workers and transit riders likely didn’t realize such a high-cost burden.

Initial signs show telecommuting, strong during the COVID-19 pandemic, has started to wane as employers and employees continued to work out working conditions and expectations. Between February and May 2022, the percentage of workers doing a hybrid schedule in the UK nearly doubled from 13% to 24%, while the share working only from home fell 36%.

In the US, office occupancy tracker Kastle Systems said that office occupancy was at 23% to start 2022, finishing the year at around 47% occupancy. In short, more people are commuting during the peak hours.

With more drivers on the road, traffic safety remains a top concern. The US fatality rate (fatalities per 100 million vehicle miles traveled) jumped from 1.07 in 2019 to 1.30 in 2021, a 21% jump, only to drop a marginal 0.03 in the first half of 2022.

And Germany recently announced it expects road fatalities to increase nearly 9% in 2022 after hitting an all-time low in 2021.[ii]

INRIX incident data reveals that year over year collisions increased in the US (+4%), the UK (+11%), Germany (+5%), and Canada (+4%), while dropping in Spain (-7%).

2022 revealed that, by and large, motor fuel remains relatively inelastic, meaning a large change in price only corresponds to a small change in fuel consumed, and that upward pressure on travel like the return to work, activities, school, shopping, and freight demand overpowered the downward pressure of fuel prices. While downtowns still have room to recover in terms of re-emerging from COVID-19, 2023 should continue to see some moderate growth in congestion, absent large disruptions to the economy.

[i] Math result difference due to rounding. [ii] Fatality & serious injury numbers often lag by as much as a year, due to necessary follow up and investigation of cause