COVID’s immediate impact on driving habits was unmistakable. Motorists abandoned the roads, and passenger vehicles sat idle in garages and driveways. Long-held assumptions about driving habits no longer applied.

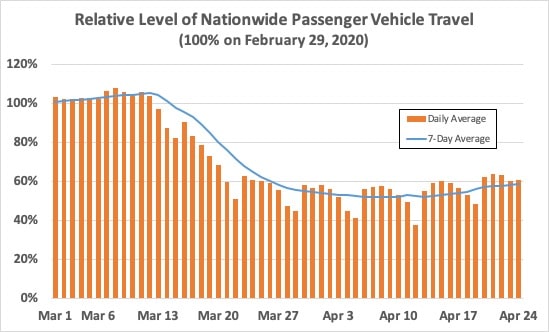

During the early months of the pandemic, millions of daily commutes suddenly stopped.The effects were dramatic. For example, in Q2 2020, In early April, vehicle-miles traveled (VMT) nationwide dropped 48%, while long haul trucking dropped 13%, from pre-COVID levels.

There were unprecedented responses to COVID’s impact on transportation. For example, auto insurers proactively offered ongoing discounts to the insured. COVID also accelerated two market trends already underway: work-from-home (WFH) and online shopping. These changes decreased VMT while increasing online auto parts sales. KPMG estimates that May-June online sales increased 45 percent compared to March.

COVID vs. Classic Recessions

VMT statistics are correlated with the health of the aftermarket industry– the more miles driven, the more that maintenance, repair, and replacement of vehicles will be required.

To understand COVID’s impact, it is important to differentiate between current recessionary pressures and past downturns. During the Great Recession, McKinsey notes that U.S. GDP dropped four percent, and VMT fell by 2.4 percent. New car sales declined 42 percent and used car sales declined by 20 percent. Aftermarket parts sales were quite resilient, dropping only one percent.

In the COVID era, it is more likely that precipitous declines will be followed by a significant rebound. INRIX VMT data and graphs support that contention. By August 2020, evening commutes had rebounded, although morning commutes still lagged well behind pre-COVID levels.

When it comes to aftermarket parts, KMPG cites reasons for optimism. For example, strong pre-COVID auto sales will somewhat offset any adverse impact on aftermarket parts. “Get ready for a pop in demand in a year or two,” KPMG suggests. The Wall Street Journal offers an optimistic assessment as well.

VMT and the Parts Market

KMPG forecasts short-term distress in the aftermarket parts market. After sustaining a CAGR of 4.7 percent from 2013-2019, it will decline at a CAGR of 14.4 percent in 2019-2020. Then, it projects sustained growth through 2025. Although KPMG sees a “demand surge on the horizon,” there are caveats. A KPMG survey revealed that almost three-fourths of consumers plan to stick with online shopping, even as stores reopen. This could “reduce VMT by as much as 9.2 percent.”

In classic recessions, VMT inevitably declines. As COVID arrived, VMT dropped overnight. At the same time, the use of leisure time also changed. Trips to restaurants, nightspots, and theaters disappeared in favor of cocooning at home.

During COVID, consumers also abandoned showrooms, and car sales declined. As a result, the overall fleet aged, shifting the “sweet spot” for repairs. In mid-2020, IHS Markit observed, “In light of COVID-19, dynamics of the changing vehicle fleet are anticipated to result in an increase in average age over the coming years, perhaps of 4-6 months.” This bodes well for aftermarket parts. KPMG estimates an average $1,400 maintenance cost over a vehicle’s first 25,000 miles. Compare that to annual maintenance costs of $4,100 after 100,000 miles.

Expect a release of significant pent-up demand as the COVID period matures and wanes. An aging fleet will invariably stimulate demand for aftermarket parts. As IHS Markit states, “more vehicles will be pushed into the aftermarket sector’s sweet spot – thereby creating good business opportunities.” It is wise to differentiate between age-dependent and VMT-dependent replacement parts. For example, batteries are more age-dependent while wear-and-tear parts are more VMT-dependent.

Also, McKinsey discusses two key aftermarket categories: required and discretionary. Required repairs include break-fix-repair incidents. Discretionary expenditures include performance parts and accessories. During the Great Recession, the former held while the latter declined. During the COVID era, break-fix-repair incidents will decline at first before rebounding.

Be Ready for the Rebound

Cost-cutting is a reality in the short-term. Many parts suppliers, parts retailers, and repair shops have already done some serious belt-tightening. During the downturn, it is vital to rethink capacity, products, channels, and pricing. Going forward, scrutinize your business for potential savings in procurement and operations. Reduce your footprint now while retaining the capacity to respond to rebounding demand later.

Positive traits that lead to business success are at a premium now. Your enterprise must be nimble, agile, responsive, and decisive. Don’t get caught flat-footed when the market rebounds. Tracking visits data, trips data, and VMT can help auto suppliers and aftermarket retails plan for demand. As VMT increases, be ready to ramp up staffing and production.

Finally, watch for changing variables that may impact markets going forward. To what degree will virus outbreaks recur? When will one or more vaccines arrive, and how effective will they be?

INRIX Solutions Make it Easy to Monitor VMT

VMT statistics are directly correlated with the health of the automotive aftermarket industry– the more miles driven, the more that maintenance, repair, and replacement of vehicles will be required.

Being able to understand the trips people take and overall VMT trends can provide tremendous insights for auto repair and maintenance service business and auto part makers.

INRIX IQ Trip Trends provides our high-quality location-based insights in an easy to use format to help the businesses quickly understand what is happening on the world’s roadways.

By analyzing hundreds of billions of anonymized daily trips, INRIX distills big data into VMT data trends and insights.

This intuitive, cloud-based platform provides market, state, and country level insights into travel demand for OTR Trucking, regional/local fleets, and passenger vehicle trips. Get access to normalized indexed values of vehicle miles traveled (VMT), trip count, trip length and trip duration to understand what transportation trends are happening around the world.

Sign up for a free trial to try INRIX Trip Trends today or contact us for more information.