Introduction

When the COVID-19 pandemic hit around March 2020, governments around the world imposed lockdown measures for “unessential” businesses, resulting in closed doors, limited hours of operation and increases in unemployment. In the United States, amusement parks shut down along with many other leisure-type businesses, leaving people searching for a replacement. Some found that replacement in national parks.

At the same time, news outlets reported increases in RV sales. Barron’s noted that the Recreational Vehicle Industry Association (an RV trade group) said RV sales increased 4.5%, “not bad for a year with three lost months of sales, a deep recession, and a pandemic-related supply chain and labor disruptions.” The RV trade group also forecasted a massive 19.5% increase in sales in 2021, while investors wondered if demand for recreational travel would hold into the next year. Using INRIX Location Analytics, we dug deeper into the impact COVID-19 had on recreation and tourism on these two major destination-types.

National Parks

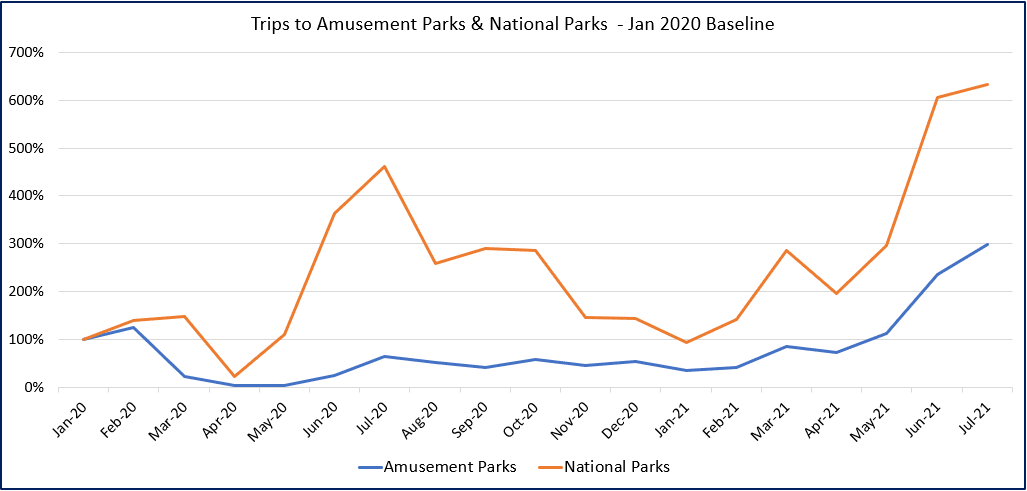

National Parks remained open throughout COVID-19. Since they are accessible by car, they became a popular way to escape the house while avoiding cramped airports, trains and planes. Throughout 2020, National Parks have continued to see visits increase from the January 2020 baseline (as expected, during the summer months visits to national parks increase), yet 2021 appears to be even stronger, with July 2021 monthly visits up 37% year over year.

Amusement Parks

Amusement Parks in 2020, on the other hand, were either completely shut down or had limited capacity. Florida’s Epcot shut down on March 15, 2020, while California’s Disneyland closed on March 13th. As a result, trips to amusement parks continued to stay below January 2020 levels until May 2021, 16 months later. Since May, however, trips to amusement parks have increased 166% through July, showing a willingness to visit theme parks post-vaccine rollout.

The results show that demand for leisure and recreational travel, whether it be national parks or amusement parks, is still very strong into 2021, despite downward pressure caused by the Delta variant, inflation, and fuel prices. This should bode well for RV dealerships and outdoor retailers like REI and Cabela’s.

Yet theme parks across the U.S. have fared differently depending on their respective locations. For example, we analyzed trips to California’s Disneyland and Florida’s Epcot Center. As Location Analytics reveals, both Disney-owned parks shut down approximately the same time, and saw similar decreases in visits.

While business in Florida opened up last summer, Disneyland in California largely reopened in April. While this has continued to place strain on Disney (it announced “parks and product division“ revenue increased from $1.1 billion through July last year to $4.3 billion this year), the outlook for theme parks continues to improve in the face of labor shortages, inflation, high fuel prices and uncertainty around the Delta Variant. Along with our recent report on mall traffic, the latest results indicate a willingness to return to in-person retail, shopping and leisure – a big hurdle as we learn to navigate around COVID-19.