Quick serve restaurants operate within competitive a landscape susceptible to extreme disruption from new entries, products, promotions, and the economy. Currently, most restaurants lack the ability to measure their performance relative to the competition. Sales alone do not capture the whole picture. Facing declining sales but defending market share against a new entrant could be a success, while increasing sales below the rate of an overall market’s growth a failure.

INRIX Research began with the question: how does the opening of a high-profile restaurant impact market incumbents?

By employing INRIX extensive data capabilities, INRIX Research tracked market changes in Los Angeles, Denver, and Charlotte for the month preceding and proceeding the opening of a Shake Shack. In all three markets, the number and share of visits were analyzed. McDonald’s and Chick-Fil-A appear in all three studies, while Wendy’s appears in two.

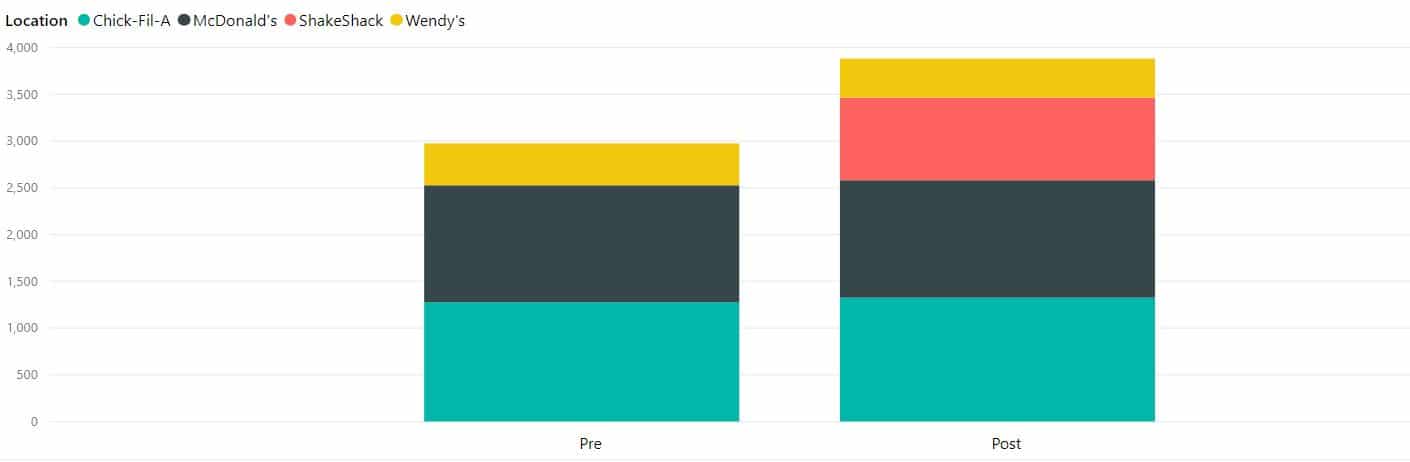

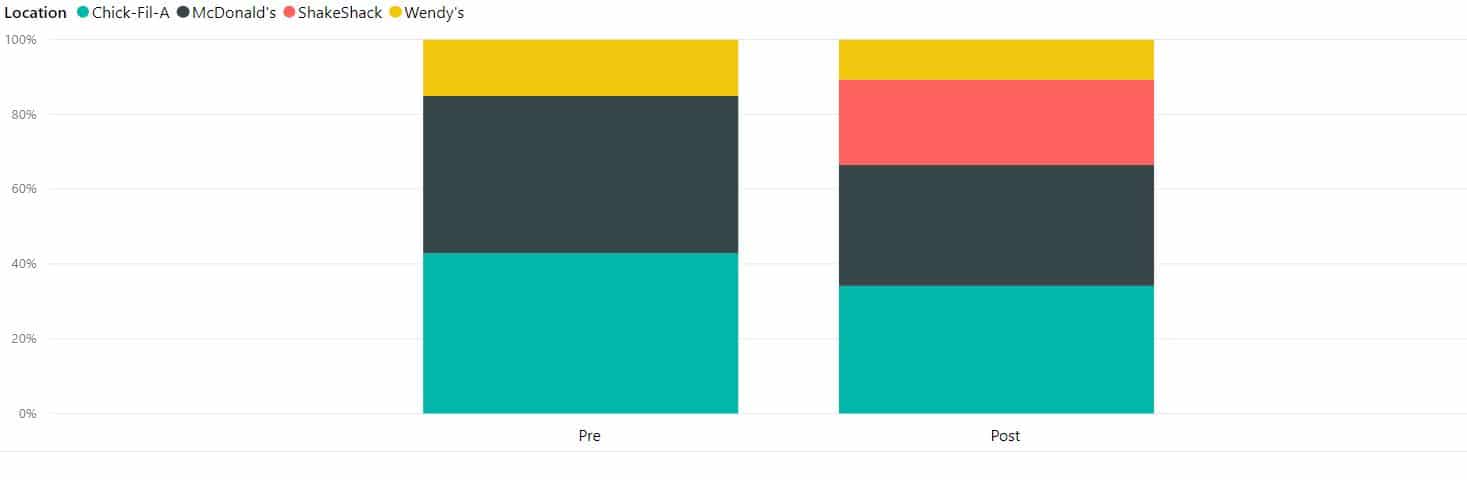

Our study found the opening of a Shake Shack typically corresponds with an increase in overall visits to an area, while incumbent market share decreased by between 2 and 5 percent. Interestingly, the number of visits to incumbents frequently increased following the opening of a Shake Shack. The opening of a Shake Shack in Denver’s Highlands Ranch neighborhood exhibits the phenomenon of incumbent visits increasing after Shake Shack’s opening.

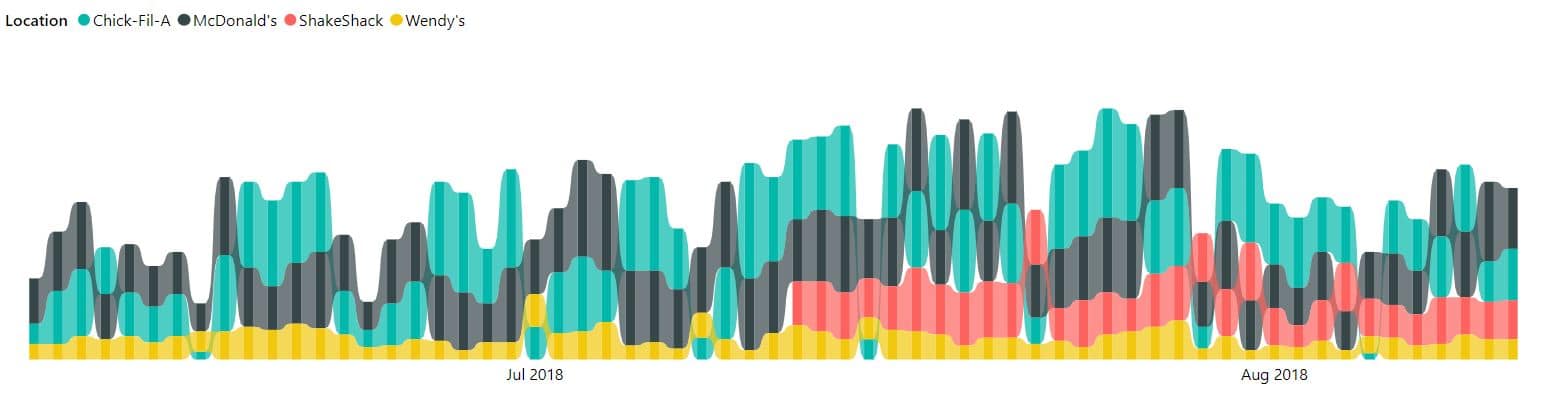

Figure 1 reveals just how dynamic the market is, particularly after Shake Shack’s opening with McDonald’s and Chick-Fil-A splitting time as the most visited restaurant in Highlands Ranch.

Figure 1

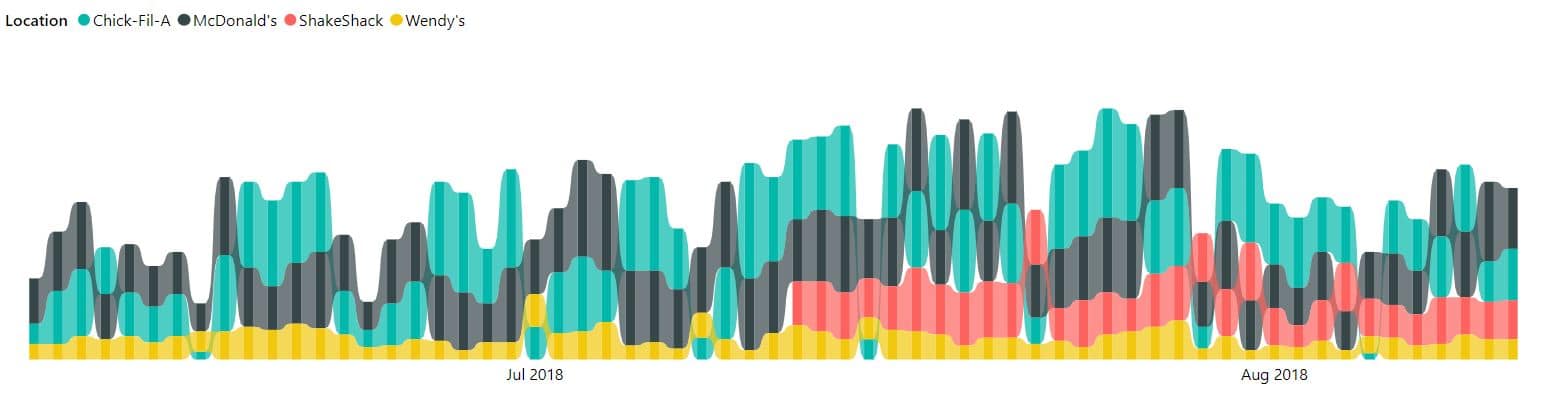

Figure 2

Figure 3

Overall INRIX Research found the opening of a Shake Shack a significant impact on incumbent market share, but a more varied impact on overall visits. In two of the three openings studied, the overall increase in visits to an area outweighed the loss of market share for incumbents. The one exception being Charlotte where overall visits decreased, which is atypical.

While this study focused exclusively on the openings of new Shake Shacks, the data methods employed have broad potential to measure a specific restaurant location’s performance in near real time relative to its competition. Going forward, the access to this kind of data will empower quick serve restaurants to adapt rapidly, and effectively, to the dynamic marketspace they find themselves.