By Rick Schuman, VP, Public Sector Americas (rick@inrix.com)

This is the tenth edition of a weekly review of changes in road traffic demand in the United States from the COVID-19 virus spread and our collective response.[1] We will endeavor to publish this Synopsis every Monday for the foreseeable future, providing results through Friday of the previous week. If interested in detailed information with daily updates, we have introduced the INRIX Trip Trends.

Key Findings

- National travel had the largest rebound yet this week in this COVID-19 period

- Four states and one metropolitan area exceeded pre-crisis personal travel levels

- Nationally, when compared to typical travel,[2] Week 10 (Saturday, May 16 – Friday, May 22) saw:

- Personal travel down 19% vs. 25% in Week 9

- Long haul truck travel down 4.6% vs. 6.1% in Week 9

- Local fleets in Metro Areas down 6% vs. 8% in Week 9

- Travel decline leaders in Week 10:

- Statewide Personal Travel: Hawaii, down 50% vs. 51% Week 9, and 62% maximum

- Statewide Long Haul Truck Travel: Michigan, down 22% vs. 29% Week 9, and 38% maximum

- Metro Area Personal Travel: San Francisco, down 42% vs. 45% Week 9, and 66% maximum

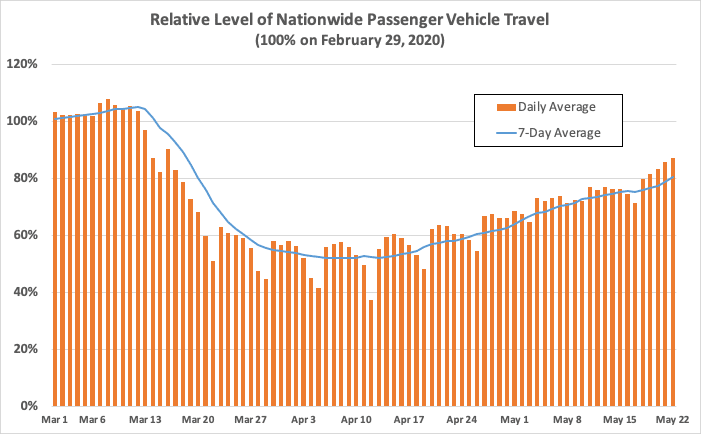

Figure 1

Background

Our incoming data sources (The ‘INRIX Fleet’) provides anonymous speed/location reporting to us in real-time and generates over 100 million trips, traveling over 1 billion total miles per day across the US. The INRIX Fleet provides information about all roads in the national network, not just major roads and spans the full range of vehicle types: consumer vehicles, local fleets, long haul trucks.

We have re-purposed our INRIX Trips metadata – with only a 48-hour lag – to generate relevant summary level information about traffic demand.[3] In this extraordinary time, we hope that this information will be useful to policy makers and the public. We look forward to the week, hopefully soon, when we can report on congestion and volume growth – as this will be a sure sign of recovery.

Synopsis

It has been ten weeks since travel began its noticeable decline nationwide. Figure 1 shows the relative change in passenger vehicle travel from March 1, relative to the comparable day of the week during the control week of February 22 – 28, 2020. Figure 1 also includes a weekly rolling average. Passenger travel continued to trend upwards with its largest weekly increase, down 19% weekly on Friday, May 22nd, compared to 25% the previous Friday and 48% on April 9th the low point to date. The weekly average was last at 19% on Friday, March 20th, just eight days into the initial travel decline.

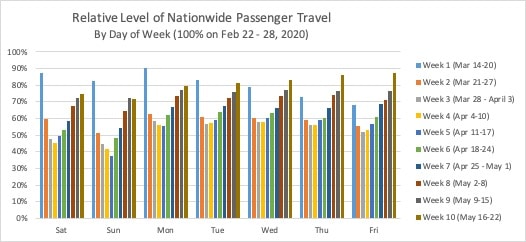

The daily figure for Friday, May 22nd was 87%, a figure last seen on Saturday, March 14th, just the second day of measurable nationwide travel decline. Figure 2 shows the daily figures each week, illustrating the travel declines stabilizing in Weeks 4 and 5, increasing since then. It is likely Memorial Day weekend travel contributes somewhat to late Week 10 results, highlighting day-to-day trends can be volatile.

Figure 2

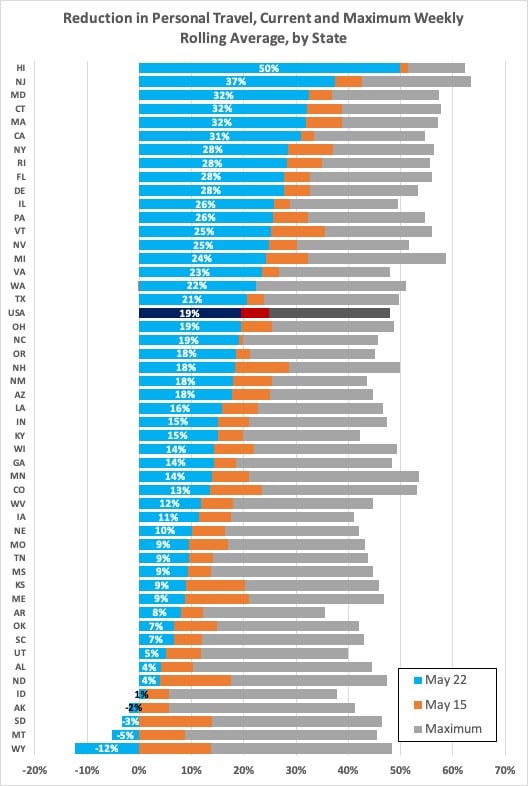

State Level Passenger Travel increased in every state compared to last week, for the fifth week in a row. 34 states increased 5% or more in Week 10. Eight states increased 10% or more: South Dakota (14%), Wyoming (14%), North Dakota (13%), Maine (12%), Kansas (11%), New Hampshire (10%), Vermont (10%), and Colorado (9%). Three states increased 1% or less: Washington, North Carolina, Hawaii. Figure 3 shows each state’s weekly rolling average on May 22nd in blue, last week’s (May 15th) in orange, and the maximum drop at any point from March 1st in gray.

Four states – Wyoming, Montana, South Dakota, and Alaska – have now exceeded control week travel. All states but Hawaii (12%) have recovered at least 24% from their maximum weekly rolling average reduction, with 26 states recovering 30% or more. Wyoming has had the largest recovery from its maximum reduction of 48%, from a 36% reduction to a 12% increase.

Nationwide Long Haul Truck travel increased in Week 10, down 4.6%, compared to 6.1% last week. 42 states had increased truck travel in Week 10. Three states increased truck travel by 4% or more: Michigan (7%), Alaska (6%), and Massachusetts (4%). Vermont (3%) and Wyoming (2%) were the only states to decrease truck travel by more than 1%.

Four states have overall reductions in truck travel exceeding 10% – Michigan (22%), Texas (17%), New Mexico (14%) and Arkansas (10%) – compared to seven states last week. 23 states, now led by Wyoming, have increased truck travel compared to the control week, up from 15 states last week.

Metropolitan Area[4] personal travel increased overall again this week, with 95 of the 98 metropolitan areas tracked increasing in Week 10. The exceptions were Seattle, Charlotte, and Greensboro, all down less than 1%. 46 areas increased 5% or more week over week, led by Mobile, Alabama for the second straight week, up 14% in Week 10. Mobile is still the only metropolitan area to fully ‘recover’, now up 15% overall. Of the other 97 areas, three have declines in the 40%’s (vs. 5 last week), 15 have declines in the 30%’s (vs. 24 last week), 37 have declines in the 20%’s (vs. 49 last week), 34 areas have declines in the 10%’s (vs. 19 last week), and 8 areas now have declines less than 10% (vs. none last week).

The ten largest reductions in travel in Week 10 were (note all increased from Week 9 however):

-

- San Francisco: 42% (45% last week)

- Miami: 41% (45% last week)

- New York City: 40% (46% last week)

- Orlando: 39% (43% last week)

- Washington, DC: 38% (41% last week)

- Philadelphia: 35% (39% last week)

- Baltimore: 35% (39% last week)

- Honolulu: 35% (37% last week)

- San Diego: 34% (37% last week)

- Fort Myers, FL: 33% (37% last week)

Personal travel has increased 17% or more from peak reduction for all 98 metropolitan areas, with 96 areas more than 20% above their peak reduction level. Honolulu now has the least ‘improvement’ at 17% (vs. 15% last week).

Local fleet traffic in metropolitan areas increased in Week 9 overall, down 6%, compared to 8% in Week 9. Seven areas increased local fleet traffic week-over-week by 5% or more, led by Detroit, MI at 7%.

Figure 3

Seasonal Adjustments

According to the Federal Highway Administration, the average daily national vehicle miles traveled in May 2019 was 14.8% higher than the daily average in February 2019.[5] The 20% reduction in nationwide personal travel actually understates the true change in expected travel. In a ‘typical’ year, indices computed in this Synopsis would be expected to naturally rise at/near 15% as our method is not adjusting for seasonal variation.

To simplify, for every 81 miles traveled in the US last week, we could have expected 115 miles if not for the virus. Thus, the 19% reduction translates into a roughly 30% reduction, seasonally adjusted. This calculation is included for illustrative purposes and to remind readers that, depending upon when the indices shown in this Synopsis return to ‘normal’ compared to the Control Week, they may or may not indicate full recovery on a seasonally adjusted basis.

INRIX Trip Trends Dashboard Upgrades

The Trip Trends Dashboard we made available in late March to enable daily access to trend data for agencies and organizations was upgraded this week. In addition to several navigation and configuration improvements, the Dashboard now enables direct comparison of national, state and metropolitan area trends in a single graphic (see Figure 4).

Figure 4

[1] Previous Issues can be found on the INRIX Blog site

[2] Given the day of week pattern of travel demand, we compare a given day and area to the same day/area in a previous week, and we are using the week commencing Saturday, February 22, 2020 as our ‘control week’

[3] Metadata used is total trip distance of all INRIX Trips originating in the country/state/region each day

[4] INRIX has established 98 metropolitan area geographies for internal purposes; these are the areas used in this analysis

[5] https://www.fhwa.dot.gov/policyinformation/travel_monitoring/tvt.cfm